Fill Out The Form To Discover Your Solar Incentives Eligibility

Solar Incentives in Ontario

Canada Greener Homes

Interest-Free Loan

Homeowners in Canada can access loans of $40,000 from the government to transition to solar energy. Repayment occurs through interest-free installments, allowing savings from solar panels to contribute to the repayment process. Ask about Net-Metering!

City of Toronto –

Home Energy Loan Program (HELP)

Through HELP, homeowners can get a low-interest loan of up to $125,000 to cover the cost of home energy improvements, including solar and energy storage. HELP allows you to repay the loan via instalments on your property tax bill and the loan can be paid off at any time without penalty. HELP also offers additional incentives for solar installations. For additional information, email homeenergyloan@toronto.ca or visit the HELP webpage.

City of Toronto –

Energy Retrofit Loan (ERL) Program

Through its ERL Program, the City offers low-interest loans to help building owners invest in energy improvements including solar and storage. The ERL offers fixed-rate financing for up to 100 per cent of the project costs at a rate equal to the City’s cost of borrowing. For more information contact the Better Buildings Partnership (BBP) at bbp@toronto.ca, or visit the ERL Program webpage.

Federal Tax

Incentive for Businesses

The federal government offers businesses tax incentives to fully expense clean energy generation projects through the Income Tax Act and Income Tax Regulations’ measures including Accelerated Capital Cost Allowance (CCA) program and the Canadian Renewable and Conservation Expense (CRCE). Due to the complexity of the tax legislation regarding clean energy equipment, we highly recommend you consult a tax attorney or an accountant to confirm all requirements are met. Learn more about the Government of Canada’s Tax Incentives for Clean Energy Equipment. The federal government recently announced a refundable Clean Technology Investment Tax Credit equal to 30 per cent of the capital cost of eligible equipment, which include solar and storage. The Credit will come into effect after the 2023 budget is announced. Read about the announcement of the Clean Technology Investment Tax Credit.

Greener Homes Rebate now goes through Enbridge

$40,000 interest free loan for 10 years is still applicable!

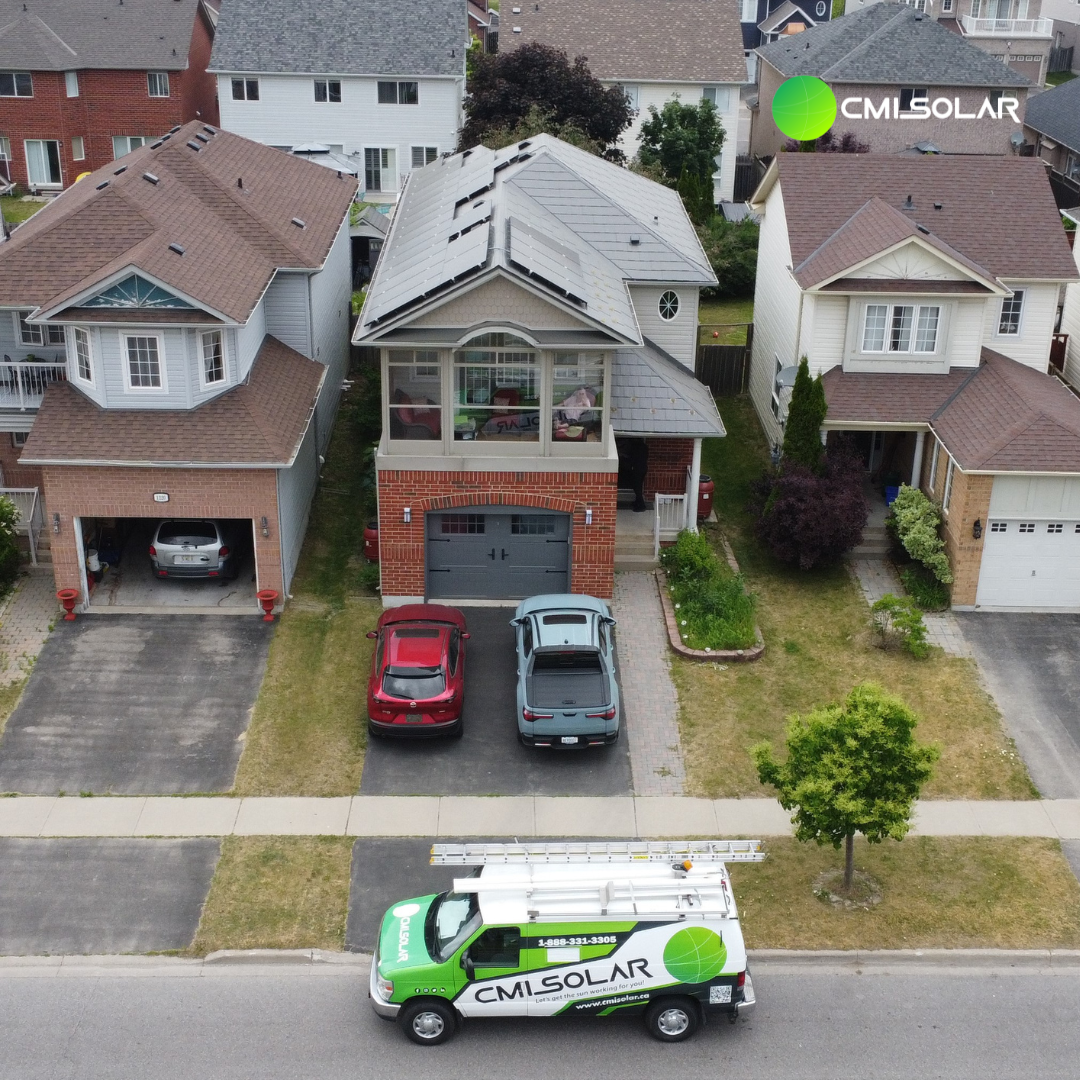

Free custom quote

“

“

Our experience with CMI Solar has been very positive. We really enjoyed their business approach and that they treated the project individually with a non-cookie cutter style. This flexibility allowed us to be more hands on and share our input into the project plans. They were very responsive to any questions and supportive throughout the process. Our system installation went rather smoothly, and CMI’s team was able to respond to any deviation with minimal delay. Additionally, to facilitate the new system our electrical panel needed to be expanded to which, CMI was able to provide the equipment and install with excellent service. Overall, the system works great and can’t wait for more sunny days. Thanks, CMI Solar.

- Anna Pawel Potemscy “

“

I purchased an EV charger and they had it installed quickly. No complaints here.

- Michael B “

“

I was surprised at how quickly CMI Solar was able to install my EV charger. It looks great on my garage wall and charges my Tesla very quickly. Now I never have to pay to charge my car again!

- Joel Smith